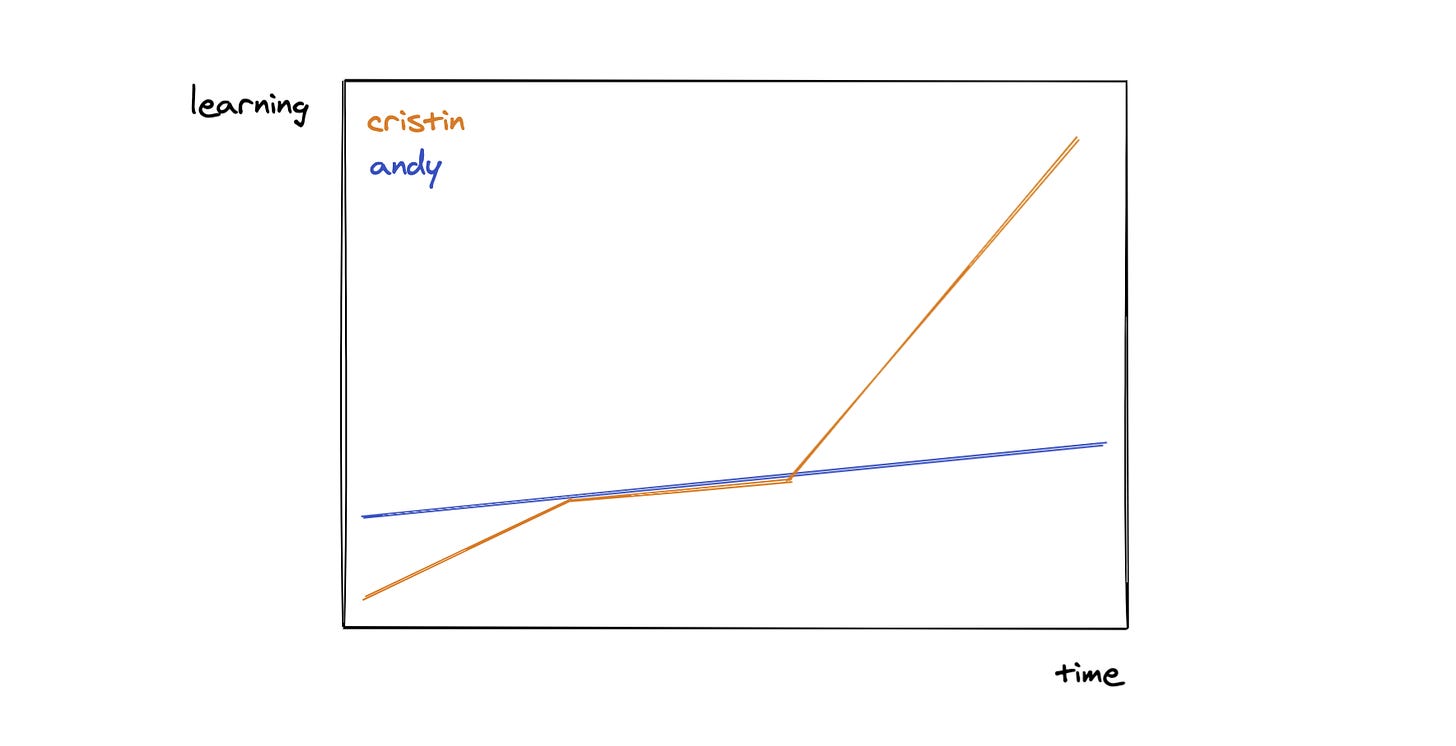

HUGE DISCLAIMER: this is not a recommendation to buy YFI. I hold YFI but it’s not a substantial position.

This is going to be sorta rushed because it’s my wife’s birthday and I need to get this out within 20 minutes. So I’ll keep it short and sweet.

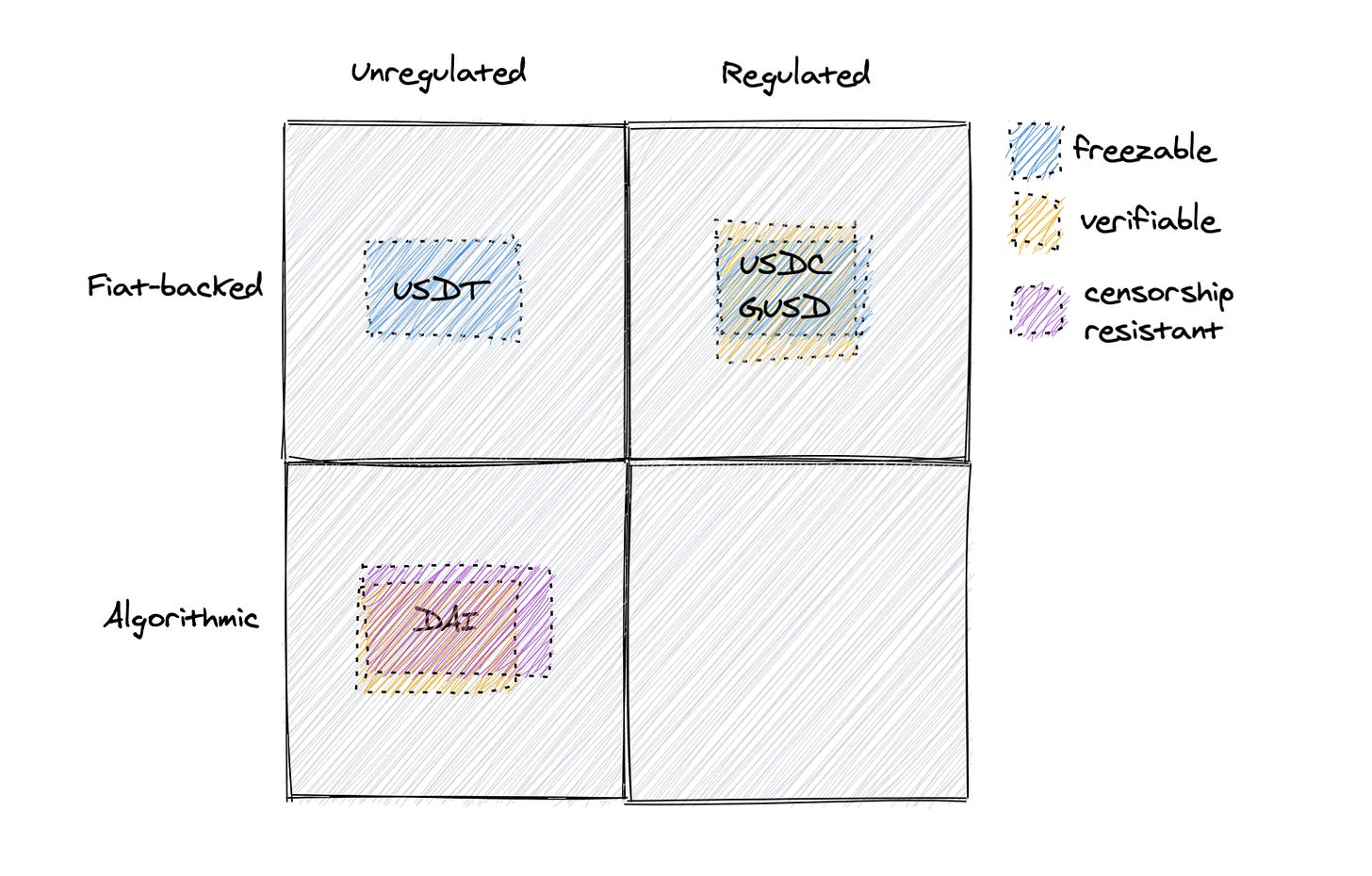

I’m not sure who to credit with the term “ponzinomics” but it’s a brilliant term for the financial engineering that’s happening in DeFi. There are good and bad things about this practice but treat my take today as completely neutral and just amused by its impact on the behaviors of everybody in the system.

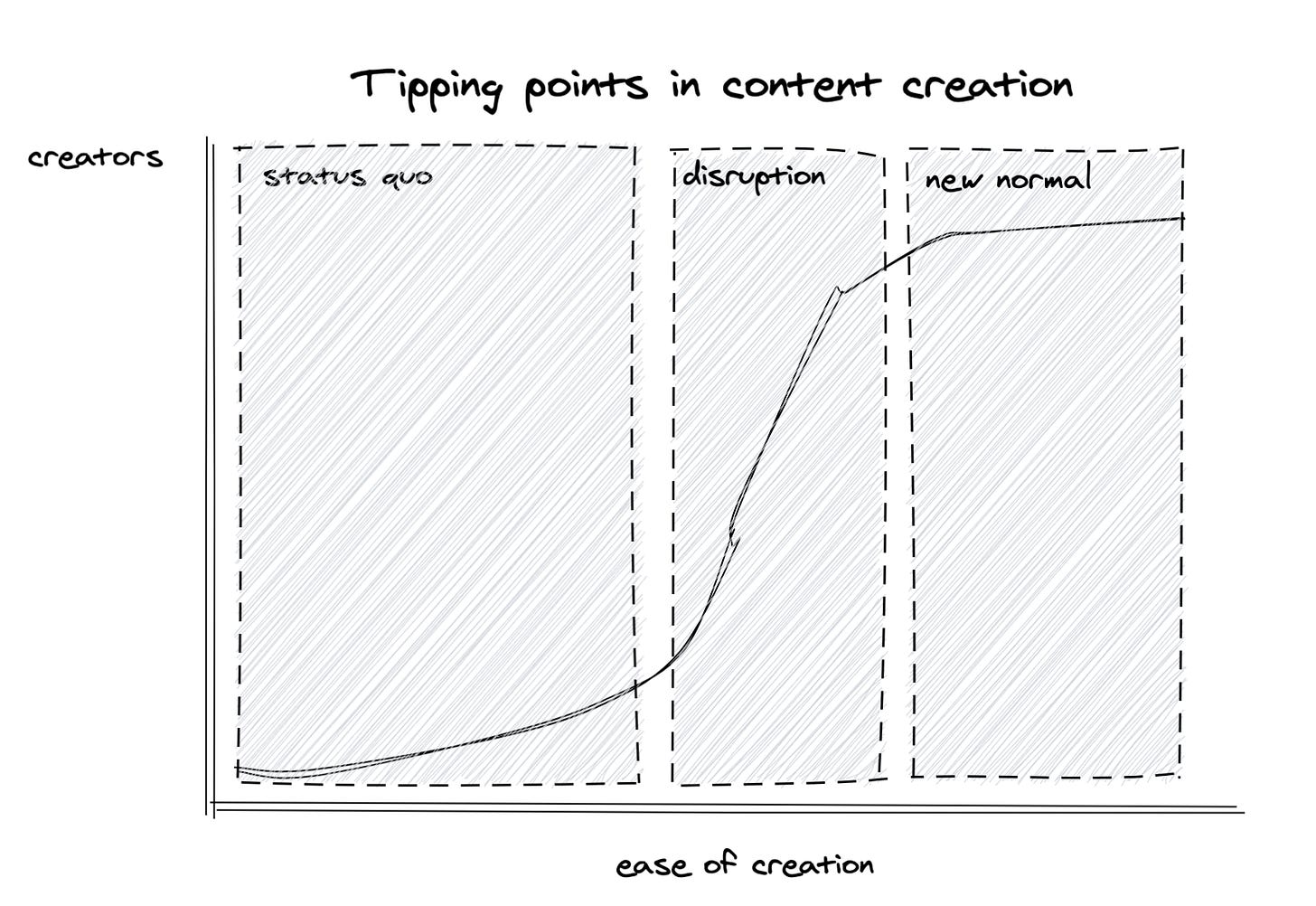

I interpret ponzinomics as setting up systems such that the price of the coin cannot help but go up.

YFI offers a few examples of how this is possible. In short, ponzinomics induce sell-side liquidity crises. This means there’s not enough supply on the red side of the order book so every marginal dollar entering the system keeps pushing the price up and up.

How do you do this? Reduce supply and increase demand duh. Here are three ways this played out with YFI.

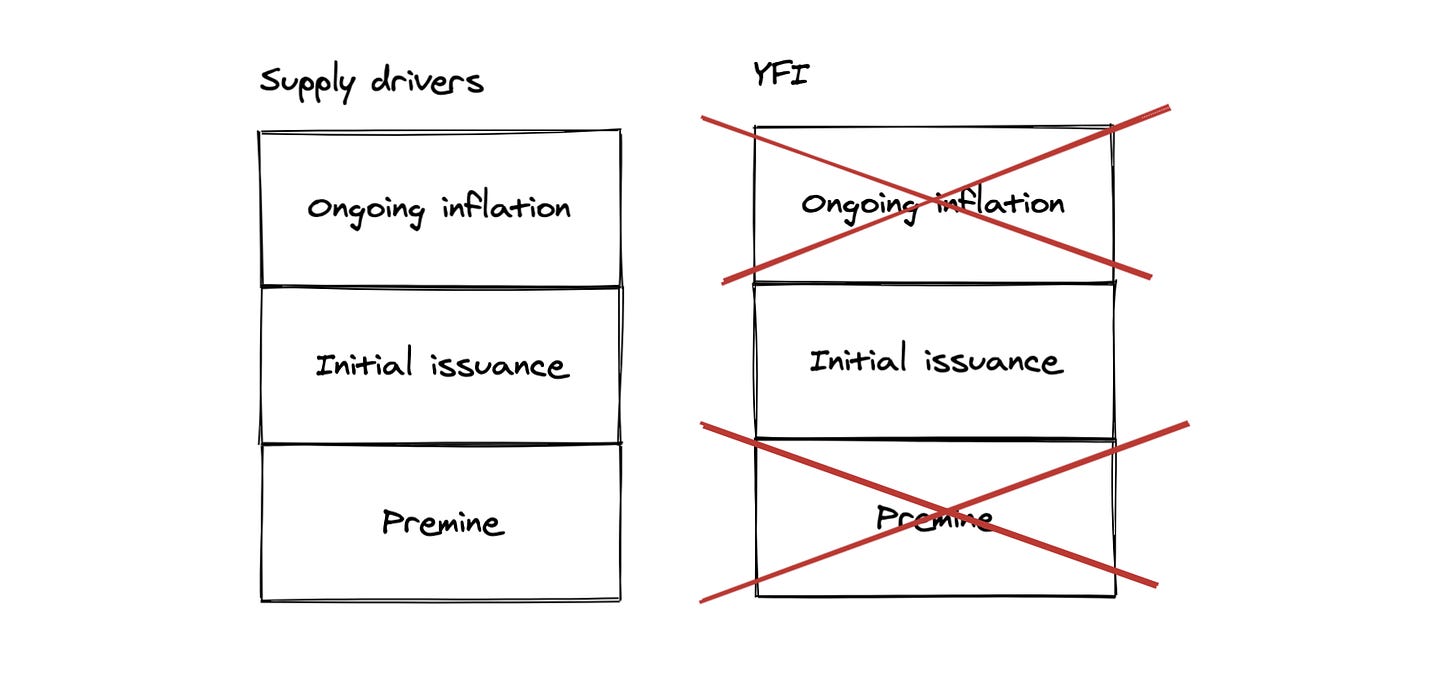

Most coins have at least two of the three supply drivers in the figure above: premine, initial issuance, and ongoing inflation.

The premine typically gets allocated to the team and early investors and can be moderated by vesting schedules.

Initial issuance is what is available to the early community of investors and users whether that’s through yield farming or a crowdsale

Ongoing inflation is what you earn from staking or using the platform on an ongoing basis

Do the exercise on your favorite coins to get a sense for this.

YFI just had an initial issuance of 30K coins distributed over seven days to liquidity providers. Because no coins were on the market, the only way to earn them was to farm them. The sellers in the market were limited to those that had already farmed them.

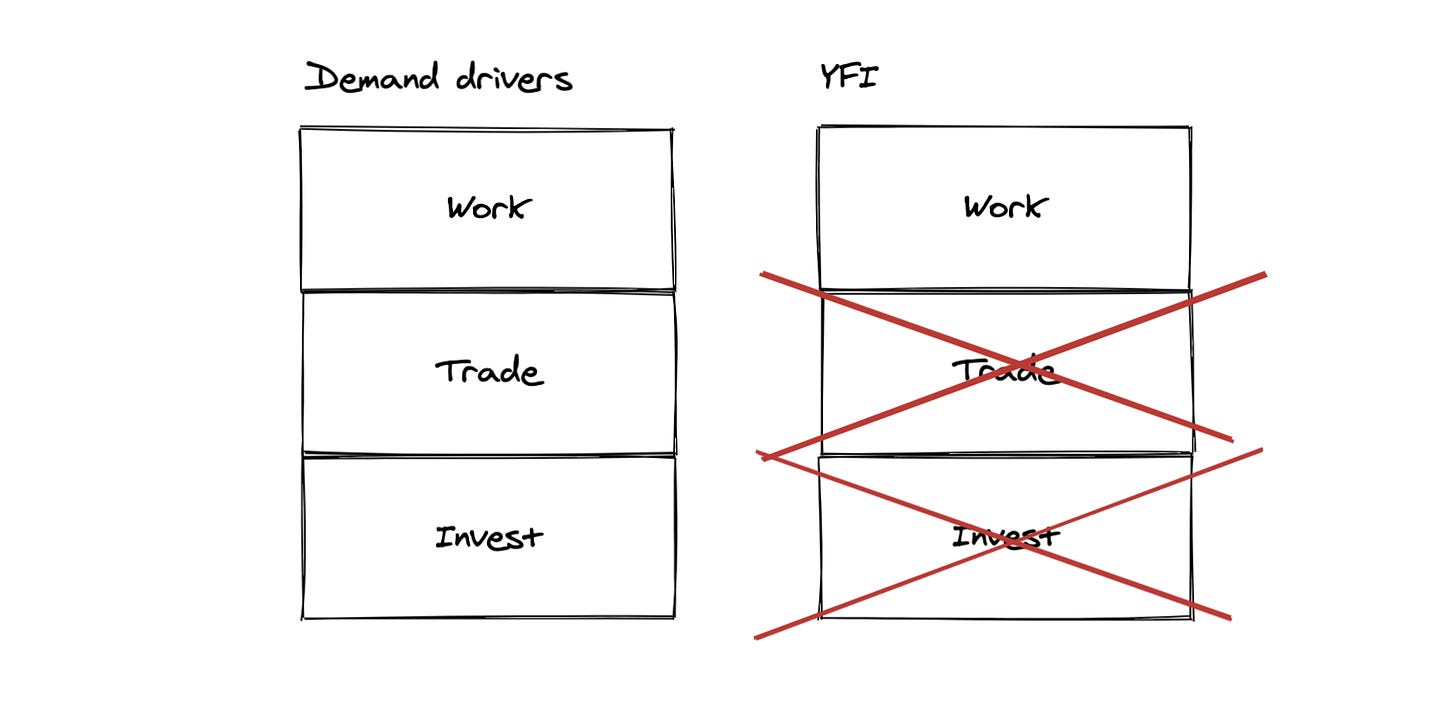

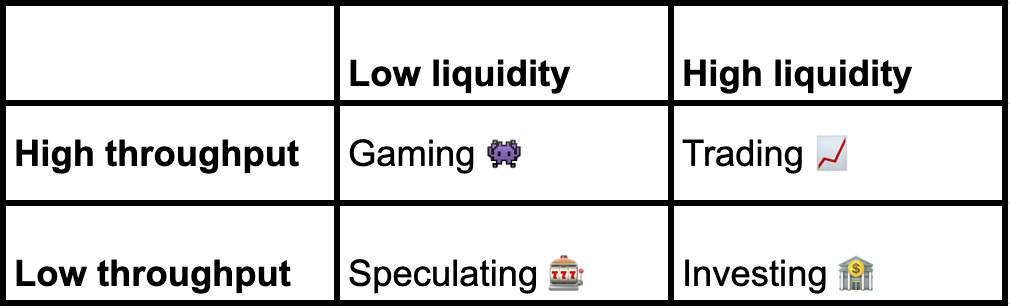

No supply doesn’t matter if there’s no demand. I simplify demand drivers into three categories:

Invest: holding the coin over a long time horizon because you believe it will appreciate due to growth of the network

Trade: holding the coin over short time frames because you think you can make money on short term volatility

Work: holding the coin to do productive work in the system to earn returns

YFI is mostly being acquired to work. This is an oversimplification and over time there will be more investors and traders in YFI markets but because YFI can be staked to earn rewards from the iearn ecosystem, users have a strong incentive to park their YFI to passively earn from the network and if they care enough, use the YFI to govern the network. (Governance of YFI is fascinating topic and something I’d like to talk about another time).

So yea less supply plus more demand = higher price… bruh you’ve discovered supply and demand I’m unsubscribing.

Okay but it all comes together in “rigged” systems that continuously lock up supply and drive demand.

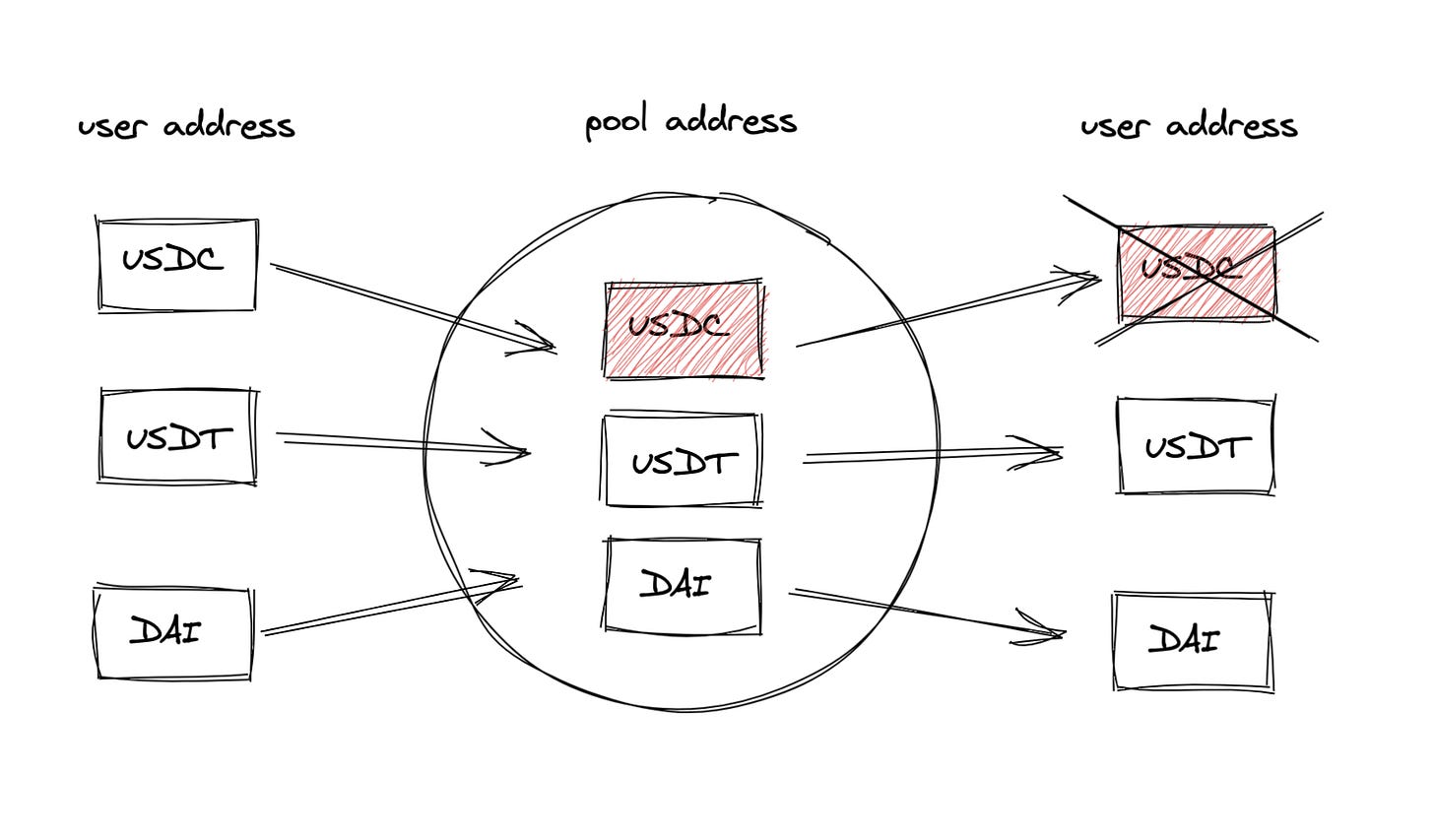

For YFI, the best example is the 2nd farming pool where users could deposit 98% Dai and 2% YFI to farm YFI. Because there was no YFI on the market, people were depositing tens of millions of Dai into the pool, which automatically converted it to YFI (effectively buying YFI at the market price). A 98/2 mix maximizes this effect (and is the most inbalanced the Balancer protocol allows).

Users are buying YFI to farm YFI. I’d venture a guess that at least half of the Dai entering that pool did not consciously realize they were “buying” YFI when staking.

These mechanics are at play with assets like SNX too. Large rewards in minting sUSD by depositing SNX simultaneously reduces SNX supply and drives SNX demand.

For YFI, I hope we see one of the most exciting experiments in community governance in blockchains history. It certainly feels like that’s possible.

For other protocols, I expect a lot more focus on cracking ponzinomics for their systems.

I’d be remiss if I didn’t mention risk. There’s a lot of it. In addition to the usual suspects, these systems are extremely reflexive. The same things that make prices gap up when things are chugging will make things gap down when the unwind. So good luck have fun but be safe.

Readers: what did I miss about YFI’s ponzinomics? What are the other great examples live today? What hasn’t been done that’s going to blow peoples’ minds?