Acquisition vs defense mindset

Last weekend, a few friends and I got to talking politics over dinner (as one does) and the topic of wealth taxes and corporate taxes came up.

How unfair, one of my friends said, is it that wealth inequality continues to grow while so many Americans live below the poverty line? We need to redistribute the wealth accumulated by the very rich and very powerful to offer a basic standard of living to everybody we can.

In Los Angeles, It’s hard to disagree with that position without seeming like a horrible miser. But disagree I did, suggesting that if we make the country less friendly to the rich and powerful, they will leave. And there will be nothing left to tax.

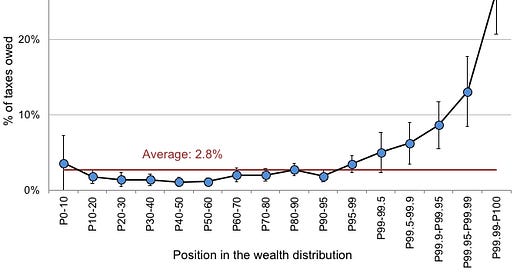

How do we know they will leave? They already do it where they can. Here’s a chart of “who evades taxes” which clearly shows the rich evade a much higher percentage of the taxes they owe.

With a goal of improving the overall wellbeing of people in America, what do you do when faced with these data?

You can try and plug the holes—increase surveillance, enforce harsher punishments, enact more restrictive laws

You can accept that the holes will never fill and search for solutions in an environment where governments lose their ability to tax their constituents

Gabriel Zucman, a professor of economics at Cal wants to plug the holes. He believes that wealth inequality threatens our political process and advocates for more “just” taxation—which in practice means better data on who owns what and using that to minimize tax avoidance:

There is this view that you can’t tax rich people, high earners, or very wealthy individuals, or they would hide assets or, again, move to low-tax places. What I want to do in my research is to try to explain how important these phenomena are, to quantify these things, to understand why we’ve let these phenomena of tax avoidance and tax evasion prosper, what are the policies and the policy failures that are responsible for this.

He’s seeing tax avoidance driving further wealth inequality which has political consequences:

It’s [wealth] the power to control the state for your own benefit. You see this very clearly in the United States, where inequality has increased enormously. And at the very same time as inequality arose, tax progressivity declined. Basically, the rich cut their tax rate.

Zucman thinks it’s unjust that wealthy individuals and corporations can hide their wealth or simply move to other geographies to avoid tax. Among his proposals are:

Making Swiss banks disclose the holdings of their customers to relevant authorities (this already is happening)

Taxing corporations based on where they are making sales rather than where they are artificially locating their businesses (e.g. Bermuda, Ireland)

His asks are reasonable enough—just close the egregious loopholes. To close those loopholes, he needs two things:

Complete disclosure of property ownership by citizens

Political capital to enact laws that minimize tax avoidance

I think he and other “plug the hole” supporters will find that (1) complete disclosure of property ownership by citizens is difficult and continues to get more difficult every day (and of course they know this which is perhaps the cause of their sense of urgency). As evidenced by the chart above, there are clearly already resources available to the rich and powerful to obfuscate their property. Adoption of non-sovereign digital moneys like bitcoin offer more ways to obfuscate—and potentially offer ways available to more people (not just the rich). In the end, I expect these efforts to plug the hole will be futile. Perhaps it will work over a short time frame but that success will catalyze a shift in mindset from acquire to defend.

Phil Bonello’s recent post on the Sovereign Individual contextualizes this shift well. In short, globalization, digital moneys, and encryption reduce the returns on violence because more people have powerful tools to defend themselves. For example:

Globalization: if you are looking to start a company, information availability helps you find the jurisdictions that will be most favorable

Digital money: if your nation’s financial system doesn’t suit you or your government wants to censor or seize your assets, you can opt into a non-sovereign digital money

Encryption: to avoid surveillance, you can encrypt your personal information to protect yourself from groups that would otherwise exploit your data for their gain

My hypothesis is that acquisition mindset is the default for most people and it takes a catalyst or some sort of environmental change to jolt people into a defense mindset. The obvious one given the topic of this post is tax. The status quo is to continue to acquire but once your jurisdiction suddenly enacts policies that threaten to seize your assets, you’ll allocate at least some of your time to defense. If a global shift towards surveillance, property seizure, and unsound governance of state moneys swells, maybe a mass shift from acquire to defend occurs.

I’m reminded of what I hear from my contacts in China. The everyday people are happy as long as things are stable and growing. They know they are surveilled, they know they do not enjoy the freedoms of a democratic country, but they are okay with it as long as they can stay in acquisition mindset. Today, only the very rich facing capital controls and potential capital seizure are in defense mindset.

The path towards plugging the holes will catalyze a mainstream shift from acquisition to defense mindset. From the perspective of governments and maybe the every day people, this could lead to short term pleasure (in that indeed wealth could be redistributed in a way that benefits more people). But this path accelerates the adoption of defense mindset, which will cause long term pain for states.

Still unsolved is the issue of how do we help the impoverished. If redistribution of wealth isn’t the way, what is? If some redistribution is required, how would we achieve that? I’m not sure here and would love suggestions from readers on what they think will help the most.