For the first time ever, a balance of USDC has been frozen by the creators of the asset, the CENTRE consortium. (Worth mentioning that USDT has frozen 22 addresses in total).

I wrote about this possibility almost two years ago in “Use regulated stablecoins, get censorship.” And over the course of the next few months wrote three other pieces on the properties of USDC/GUSD, DAI, and USDT (unfortunately behind the old paywall).

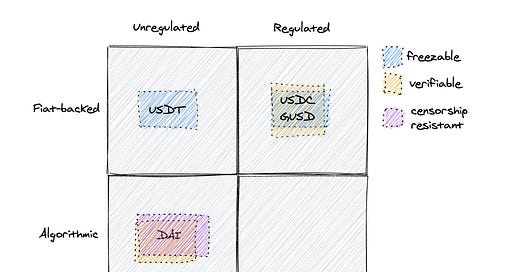

Properties of stablecoins

This figure basically sums up my thinking from that time:

The fiat-backed stablecoins on the market were censorable, but at least USDC and GUSD were regulated and thus held verifiable reserves. But if you needed non-sovereign money tracking the value of USD, then you need to go with something like Dai.

My three positions were:

(1) USDT demand would go away because it's neither uncensorable or verifiable.

Regulated stablecoins are less risky than USDT for users that don't need a censorship resistant store of value

Censorship resistant stablecoins are less risky than USDT and Regulated stablecoins for users that need censorship resistance

So that leaves you with USDT in the awkward middle where there's no market.

Wrong so far. USDT demand has ballooned. I continue to be surprised that Asian traders favor USDT to other stablecoins.

(2) Cautiously supportive of USDC adoption because I thought it could convert speculators on Coinbase to users of web3:

Do we want Coinbase to successfully onboard their millions of users to USDC? As I've writtenbefore, a programmable and stable money is a boon to crypto adoption as long as we remember that it's censorable. Coinbase has the opportunity to increase the probability that any one of their users goes from crypto speculator to crypto user--the most important step in the funnel--so I guess I'm cautiously cheering them on.

Directionally correct. USDC demand has also ballooned and has become a core piece of DeFi and what seems to be a primary on-ramp for users.

(3) Only censorship resistant stablecoins could compete for non-sovereign money

This one is too soon to know but the majority of today’s users seem happy using censorable fiatcoins. We’ll have to see if this changes as awareness of censorability increases.

Stablecoins as collateral

The biggest thing that has changed since I wrote those posts is DeFi. Back then, people were using stablecoins almost entirely as a reserve currency for trading on centralized exchanges. Now stablecoins are being pooled and lent and leveraged through a complex system of smart contracts.

Stablecoins are the biggest form of collateral in what should be “trustless” systems.

Bad assets were one of three risks I outlined in my thread on yield farming which I described as “the value in the asset itself gets robbed.”

The toy example I gave was a fiatcoin that wasn’t fully backed by reserves. Getting your balance frozen is another. But what was difficult to articulate at the time was how somebody else’s bad asset could lead to your losses due to the interconnectedness of DeFi.

Here’s a toy example of a hypothetical pool of stablecoins.

The user deposits USDC, USDT, and DAI into the pool. We later learn that a horrible criminal has also deposited USDC into that pool and as a result, the USDC in that pool gets frozen. When the user goes to withdraw their funds, they don’t get their USDC back. Depending on how the pool is constructed, they might not get anything back!

This example isn’t likely to happen (it’s a toy example!), but I wanted to illustrate how unsafe collateral can take down entire link of DeFi. And given how DeFi is a network of links, taking down one link could lead to failures in many other places.

Be careful out there!

Right! Focusing on Maker, the long-tail risk of USDC collateral being blacklisted by Coinbase/Circle is not well understood and difficult to quantify. Maker's USDC/USD oracle is hardcoded at $1, so it's unclear what would happen if USDC collateral was blacklisted or by what mechanism the system would self-heal.

USDT demand has ballooned in China because the liquid of USDT/CNY of OTC in OKEx, Huobi and Binance and other main exchanges is higher a lot than other stable coins.